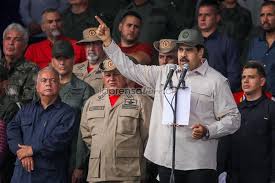

Ecuador announced on Thursday its exit from the Bolivarian Alliance for the Peoples of Our America (ALBA) in response to the humanitarian crisis in Venezuela, a country from which progressively has been distancing since Lenin Moreno came to the Presidency.

“Ecuador will not continue its participation in the ALBA,” Foreign Minister Jose Valencia announced today in an appearance in which he explained that his country wants to “reinforce” the search for a solution to the political problem in that country and to the massive exodus of Venezuelans.

The decision was announced at a meeting of several Ecuadorian ministers with media at the Carondelet Palace, headquarters of the Presidency, which addressed the problem of the massive flow of Venezuelans who have arrived in the country since the beginning of the year.

Valencia stressed that it is a problem that can not be “addressed by a country individually”, but requires “a response from all the nations of the region,” and that Ecuador’s exit from ALBA is precisely what it is about. boost that solution.

“The departure of Venezuelan citizens from their country is the result of Venezuela’s economic and political crisis. The repercussions are regional, however, Ecuador will always be in solidarity, “warned the head of Ecuadorian diplomacy.

But he described as “inhumane” the action of the Venezuelan Government for allowing millions of people to leave the country as a result of a political, economic and social crisis, and exposed the notorious frustration of their country “for the lack of political will, first place, of the Government of Venezuela to open the doors to a democratic solution “.

A criticism of Venezuela that has been rising in recent months, particularly since Minister of Foreign Affairs María Fernanda Espinosa left the Foreign Ministry in June, from the most left wing of the Executive.

Under the new chancellor, Moreno’s government seems to take new directions in foreign policy, far from those of its predecessor, Rafael Correa.

Even so, Valencia explained that Ecuador maintains “a principled position” and that it does not align with those of “no particular group in the proposal that the problem of Venezuelans be solved among them, in the democratic framework.”

He also assured that the departure of Ecuador from the ALBA does not mean the intention to join any other regional integration organization.

ALBA was created in 2004 as a mechanism for the cooperation of the countries of Latin America and the Caribbean based on solidarity and complementarity of national economies, in an alternative to the Free Trade Area for the Americas (FTAA) promoted in its moment for the United States.

The minister indicated in that sense that with the decision to leave the bloc, what is being sought is to “ratify the independence” of his country in “its general action in regional politics, an action marked in principles”.

According to data released by the United Nations High Commissioner for Refugees (UNHCR) and the International Organization for Migration (IOM), 2.3 million Venezuelans are living outside their country, of which more than 1.6 million they have abandoned it since 2015.

“90% has gone to South American countries,” according to a press release.

The head of Ecuadorian diplomacy said that it is the “greatest exodus of people in the recent history of Latin America” and recalled the initiative of his country to convene a regional technical meeting on September 17 and 18 in Quito.

This is within the belief, according to the minister, that “only a democratic stability (in Venezuela) will produce economic stability that prevents the continuation of the exodus of its citizens.”

And he clarified, explaining the position of his country, that Ecuador must give a humanitarian and full response to a situation that is “emerging and unprecedented.”

As for the measure of requesting a passport to Venezuelan citizens since August 18, he said that after a meeting with the Venezuelan deputy foreign minister for Latin America and the Caribbean, Alexander Yánez, they considered it necessary to provide travel documents.

Valencia stressed that the action of requesting the passport was communicated in advance to UNHCR and the UN, in order to verify the identity of the persons.

In the same appearance, the Minister of the Interior, Mauro Toscanini, explained that “immigration control has been strengthened” in the steps of “Rumichaca, Huaquillas and Mascarilla”.

“There are 200 more policemen in Rumichaca and police support for buses that move with migrants and seven police points along the humanitarian corridor,” he said.